Some Ideas on Estate Planning Attorney You Need To Know

Some Ideas on Estate Planning Attorney You Need To Know

Blog Article

See This Report about Estate Planning Attorney

Table of ContentsThe Basic Principles Of Estate Planning Attorney How Estate Planning Attorney can Save You Time, Stress, and Money.The Best Guide To Estate Planning AttorneyEstate Planning Attorney - Questions

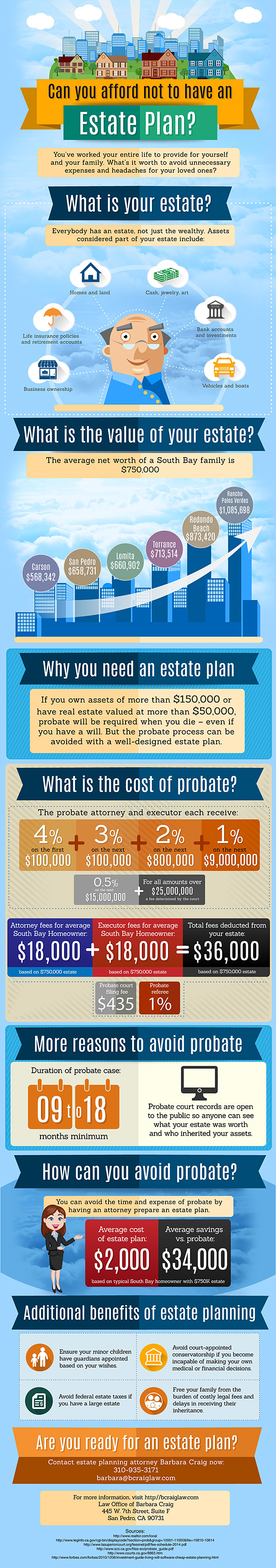

Estate planning is an action strategy you can make use of to determine what happens to your possessions and commitments while you're alive and after you die. A will, on the other hand, is a legal paper that outlines how possessions are distributed, that takes treatment of youngsters and animals, and any type of other desires after you pass away.

The executor additionally has to repay any type of tax obligations and debt owed by the deceased from the estate. Financial institutions normally have a limited amount of time from the date they were notified of the testator's fatality to make insurance claims against the estate for cash owed to them. Insurance claims that are rejected by the executor can be brought to justice where a probate judge will have the last word as to whether or not the case is valid.

The Main Principles Of Estate Planning Attorney

After the stock of the estate has been taken, the value of possessions computed, and tax obligations and debt repaid, the executor will then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within nine months of the date of fatality.

Each private places their possessions in the trust fund and names someone aside from their spouse as the beneficiary. Nevertheless, A-B trust funds have actually become less popular as the inheritance tax exemption works well for a lot of estates. Grandparents might move possessions to an entity, such as a 529 strategy, to sustain grandchildrens' education and learning.

Fascination About Estate Planning Attorney

Estate planners can work with the benefactor in order to minimize gross income as an outcome of those contributions or create methods that optimize the impact of those donations. This is an additional technique that can be used to restrict death tax obligations. It includes an individual securing the current worth, and therefore tax responsibility, of their property, while connecting the value of future development of that capital to an additional person. This approach includes cold the value of a property at its value on the day of transfer. Accordingly, the quantity of potential funding gain at fatality is likewise iced up, allowing the estate coordinator to estimate their prospective tax obligation liability upon fatality and better strategy for the payment of earnings tax obligations.

If sufficient insurance policy proceeds are readily available and the policies are correctly structured, any kind of income tax on the regarded dispositions of possessions adhering to the fatality of an individual can be paid without turning to the sale of properties. Proceeds from life insurance policy that are obtained by the recipients upon the death of the insured are normally revenue tax-free.

Other charges connected with estate preparation consist of the preparation of a will, which can be as low as a few hundred dollars if you utilize among the ideal online will makers. There are specific papers you'll require as component of the estate preparation procedure - Estate Planning Attorney. Some of the most common ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There see here now is a myth that estate planning is only for high-net-worth individuals. That's not true. In truth, estate planning is a tool that everybody can utilize. Estate planning makes it simpler for individuals to determine their wishes prior to and after they pass away. In contrast to what the majority of individuals think, it extends past what to do with properties and responsibilities.

Getting My Estate Planning Attorney To Work

You must start preparing for your estate as soon as you have any kind of quantifiable asset base. It's a recurring check my source process: as life proceeds, your estate plan need to change to match your situations, in line with your brand-new objectives. And keep at it. Not doing your estate preparation can cause unnecessary financial problems to loved ones.

Estate planning is commonly assumed of as a tool for the affluent. Estate preparation is additionally a great means for you to lay out strategies for the care of your small kids and pets and to outline your dreams for your funeral service and favored charities.

Eligible applicants that pass the test will be formally licensed in August. If you're eligible to sit for the test from a previous application, you may file the brief application.

Report this page